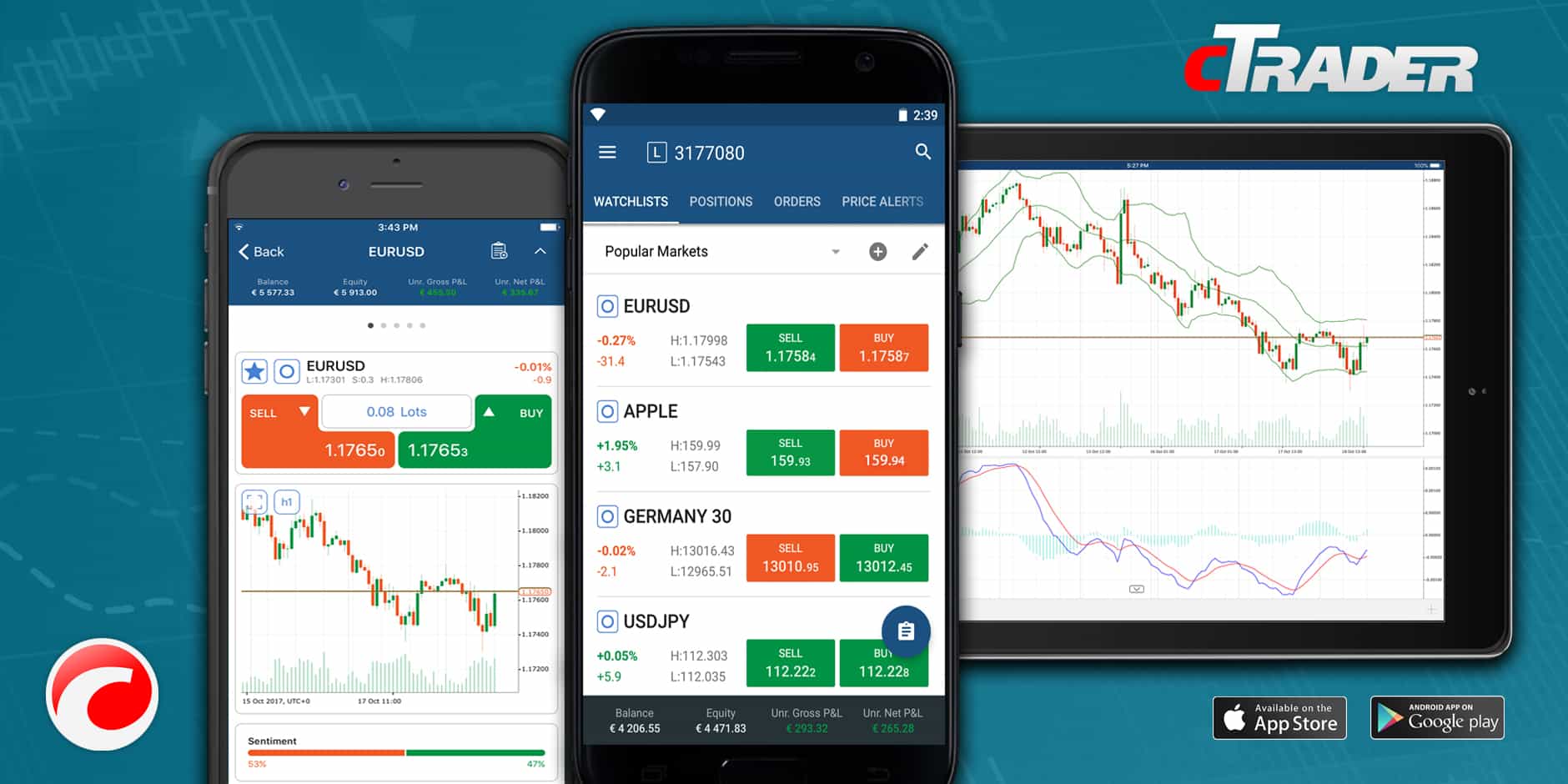

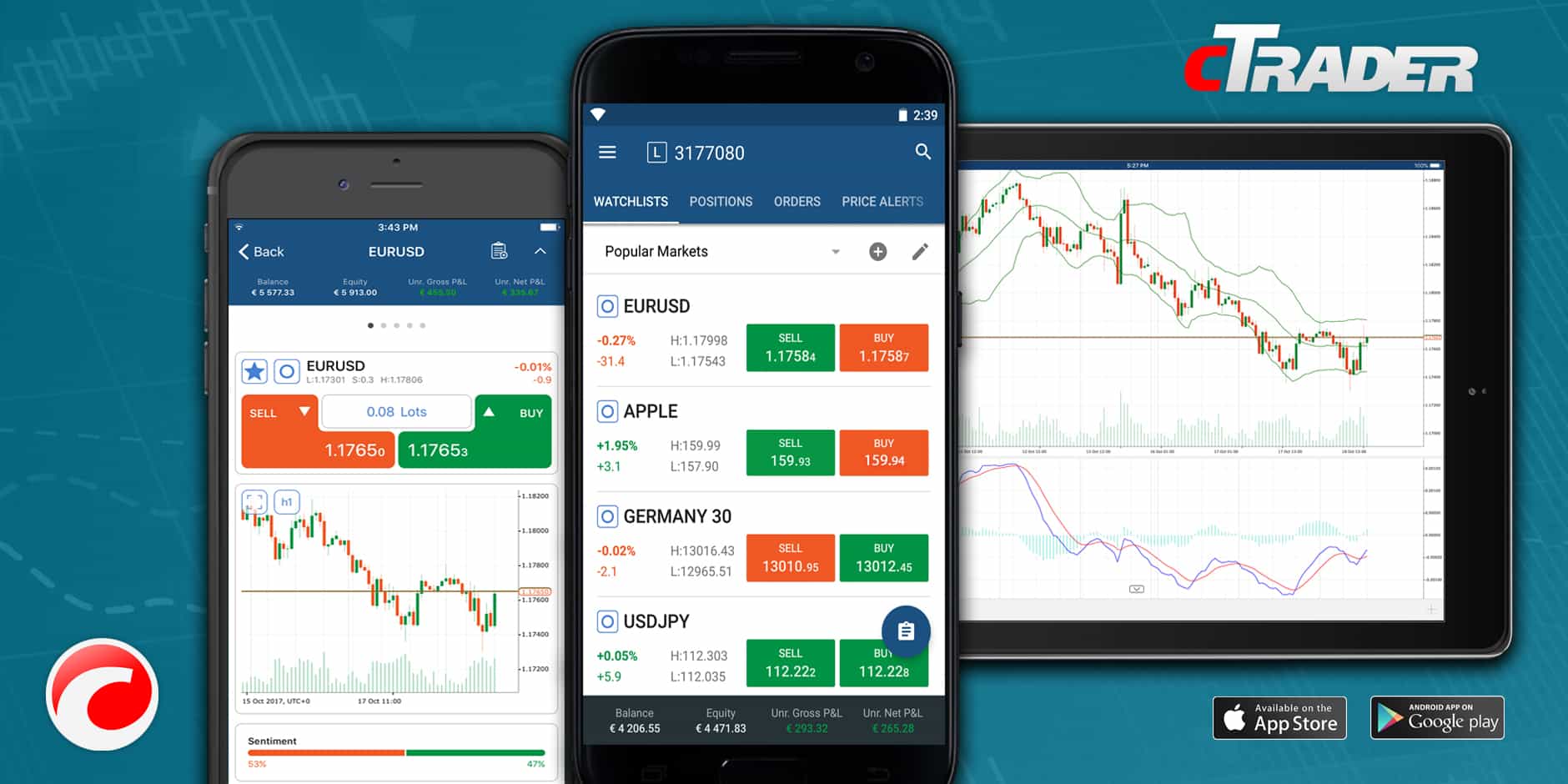

Is a Bitcoin Wallet the Same as a Bitcoin Address?. Interview: XTB’s Achraf Drid Discusses FX Growth and MENA Region. Read this Term providers, CRMs and data-vendors. When there is lack of liquidity on a certain market, slippage can occur - the order is executed at a price which is the closest available to the one requested by the client. Traditionally brokers are split between internalizing flows and offloading trades of their clients to different liquidity providers.Generally, retail brokers and their clients prefer more liquid assets which lead to better fill rates and less slippage. By doing that however they are exposing themselves to carry the risk on the trade.Liquidity providers can be prime brokers, prime of primes, other brokers or the broker’s book itself. Companies which are large enough and have material client flows consistently are creating their own liquidity pools from the order flow of their clients, thereby internalizing flows and saving on costs to send customer orders to the interbank market. The main characteristic of liquidity is its depth, which will determine how quickly and how big of an order can be executed via the trading platform.Understanding LiquidityLiquidity can be internal or external depending on the size and the book of the broker. Foreign exchange is considered to be the most liquid asset class.Brokers can source liquidity from a single or multiple source, thereby delivering to their clients enough market depth for their orders to get filled. The more liquid an asset is, the easier it is to sell and buy on the open market. It is a basic characteristic of every financial asset - be it a currency, stock, bond, commodity or real estate. Liquidity is at the core of every broker’s offering. Since launching a decade ago, cTrader is now used by more than 60 different brokers, provides trading for millions of investors, and has been integrated with more than 40 Liquidity The company’s flagship platform is cTrader, which is one of the most prominent FX and CFD trading platforms in the industry. To learn about new features, please join the cTrader Facebook Link: or Telegram Link: group.Spotware is a provider of online trading platforms and applications for brokers, which aim to convert and retain clients. This is an environment for brokers and traders to test the features of the application only.

Spotware cTrader is a demo application (Public Beta) where there is no real trading available. 23 Languages: Access all platform features translated in your native language.

Manage Sessions: Log off your other devices. Symbol Watchlists: Group and save your favourite symbols. Price Alerts: Get notified when a price hits a specified level. Trade Statistics: Review your strategies and trade performance in detail. All accounts in one app: Switch swiftly through your accounts with a simple click. Push and Email Alert Configuration: Choose which events you want to know about. 8 Chart Drawings: Horizontal, Vertical & Trend Lines, Ray, Equidistant Channel, Fibonacci Retracement, Equidistant Price Channel, Rectangle. 5 Chart View Options: Candlesticks, Bar Chart, Line Chart, Dots Chart, Area Chart. 4 Chart Types: Standard Time Frames, Tick, Renko and Range charts. Sophisticated Technical Analysis tools, with advanced settings for all indicators and drawings: Market Sentiment Indicator shows how other people are trading.

Manage Sessions: Log off your other devices. Symbol Watchlists: Group and save your favourite symbols. Price Alerts: Get notified when a price hits a specified level. Trade Statistics: Review your strategies and trade performance in detail. All accounts in one app: Switch swiftly through your accounts with a simple click. Push and Email Alert Configuration: Choose which events you want to know about. 8 Chart Drawings: Horizontal, Vertical & Trend Lines, Ray, Equidistant Channel, Fibonacci Retracement, Equidistant Price Channel, Rectangle. 5 Chart View Options: Candlesticks, Bar Chart, Line Chart, Dots Chart, Area Chart. 4 Chart Types: Standard Time Frames, Tick, Renko and Range charts. Sophisticated Technical Analysis tools, with advanced settings for all indicators and drawings: Market Sentiment Indicator shows how other people are trading.

Fluid & Responsive Charts and QuickTrade Mode allow for one-click trading.Links to News Sources inform you about events that may affect your trading.Symbol Trading Schedules show you when the market is open or closed.Detailed Symbol Information helps you understand the assets you are trading.Spotware cTrader (Public Beta) latest versionĭirect processing (STP) and No Dealing Desk (NDD) trading platform:

0 kommentar(er)

0 kommentar(er)